In today's digital age, organizations face an ever-increasing threat of cyberattacks and data breaches. These incidents can have severe financial and reputational consequences.

To mitigate these risks, many organizations turn to cyber insurance as a crucial component of their risk management strategy. In this article, we delve into the lessons learned from past experiences and explore best practices for obtaining comprehensive cyber insurance coverage.

By understanding the importance of cyber insurance and implementing effective strategies, organizations can protect themselves against cyber risks and enhance their overall security posture.

The Significance of Cyber Insurance

Cyber insurance provides financial protection to organizations in the event of a cyber incident. It helps cover the costs associated with data breaches, ransomware attacks, business interruption, legal expenses, and regulatory fines. The significance of cyber insurance can be summarized as follows:

1. Financial Protection:

Cyber incidents can result in significant financial losses. Cyber insurance helps organizations mitigate these losses by covering expenses such as forensic investigations, legal fees, notification costs, credit monitoring, and potential liability claims.

2. Reputation Management:

A data breach or cyber incident can damage an organization's reputation and erode customer trust. Cyber insurance often provides access to public relations and communication experts who can assist in managing the fallout and minimizing reputational damage.

3. Compliance and Legal Obligations:

Organizations are increasingly subject to stringent data protection regulations. Cyber insurance can assist in meeting legal obligations by covering fines and penalties associated with non-compliance.

Lessons Learned from Past Experiences

Several high-profile cyber incidents have provided valuable lessons that can guide organizations in their approach to cyber insurance. By examining these incidents, we can identify key takeaways:

1. Risk Assessment:

Conduct a thorough risk assessment to understand the organization's specific vulnerabilities and exposures. This assessment should consider the nature of the business, the sensitivity of the data, the strength of security controls, and any previous incidents. Understanding these risks allows organizations to tailor their cyber insurance coverage accordingly.

2. Incident Response Planning:

Develop a robust incident response plan that outlines the steps to be taken in the event of a cyber incident. This plan should define roles and responsibilities, communication protocols, and strategies for minimizing the impact of an incident. Insurers often evaluate an organization's incident response capabilities when underwriting cyber insurance policies.

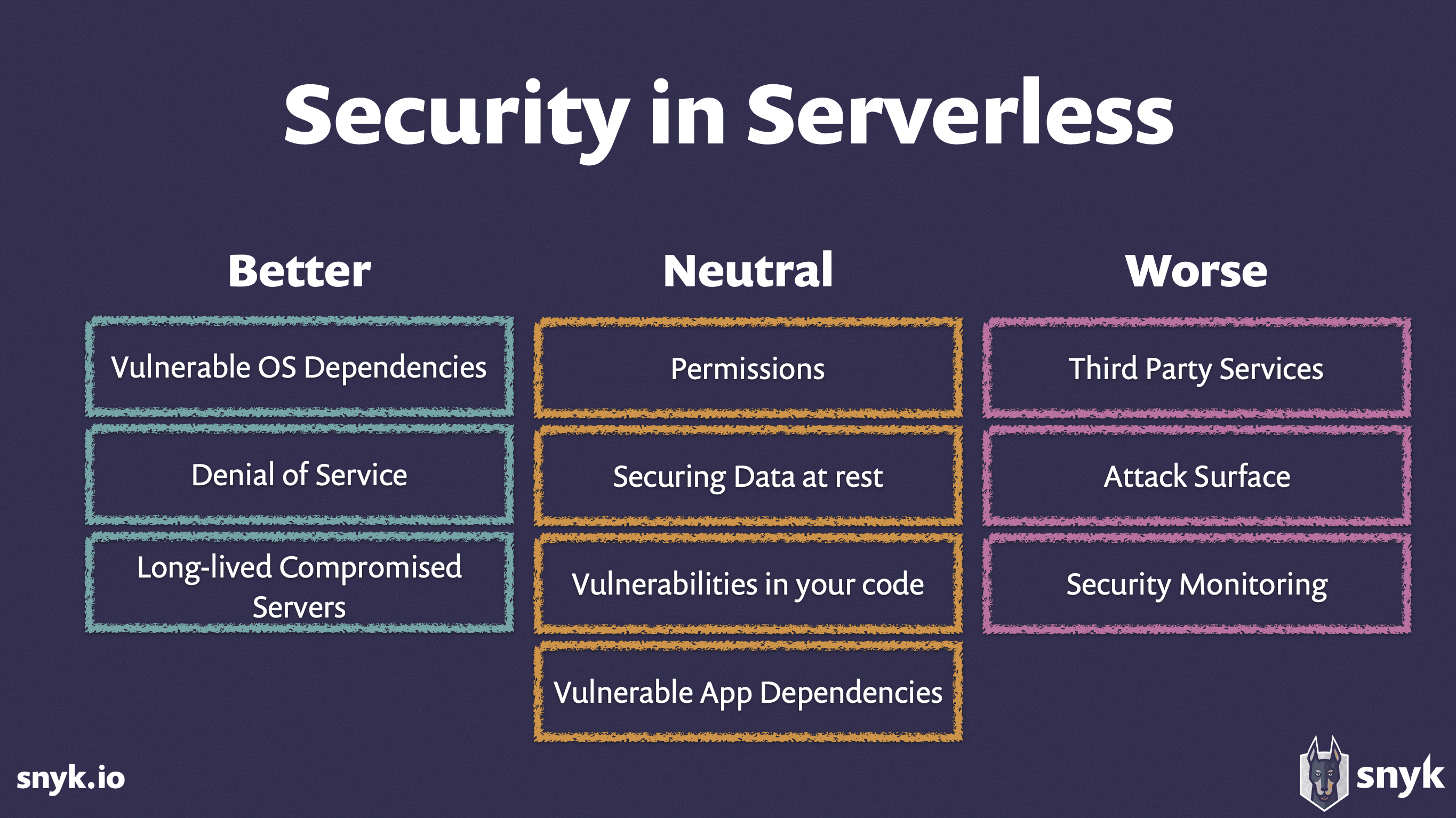

3. Vendor Due Diligence:

Organizations often rely on third-party vendors for various services. It is crucial to assess the security posture of these vendors and ensure they have appropriate cyber insurance coverage. In the event of a breach caused by a vendor, the organization's cyber insurance may not cover the full extent of the damage.

Best Practices for Obtaining Comprehensive Cyber Insurance Coverage

To ensure comprehensive coverage, organizations should consider the following best practices when obtaining cyber insurance:

1. Conduct a Comprehensive Risk Assessment

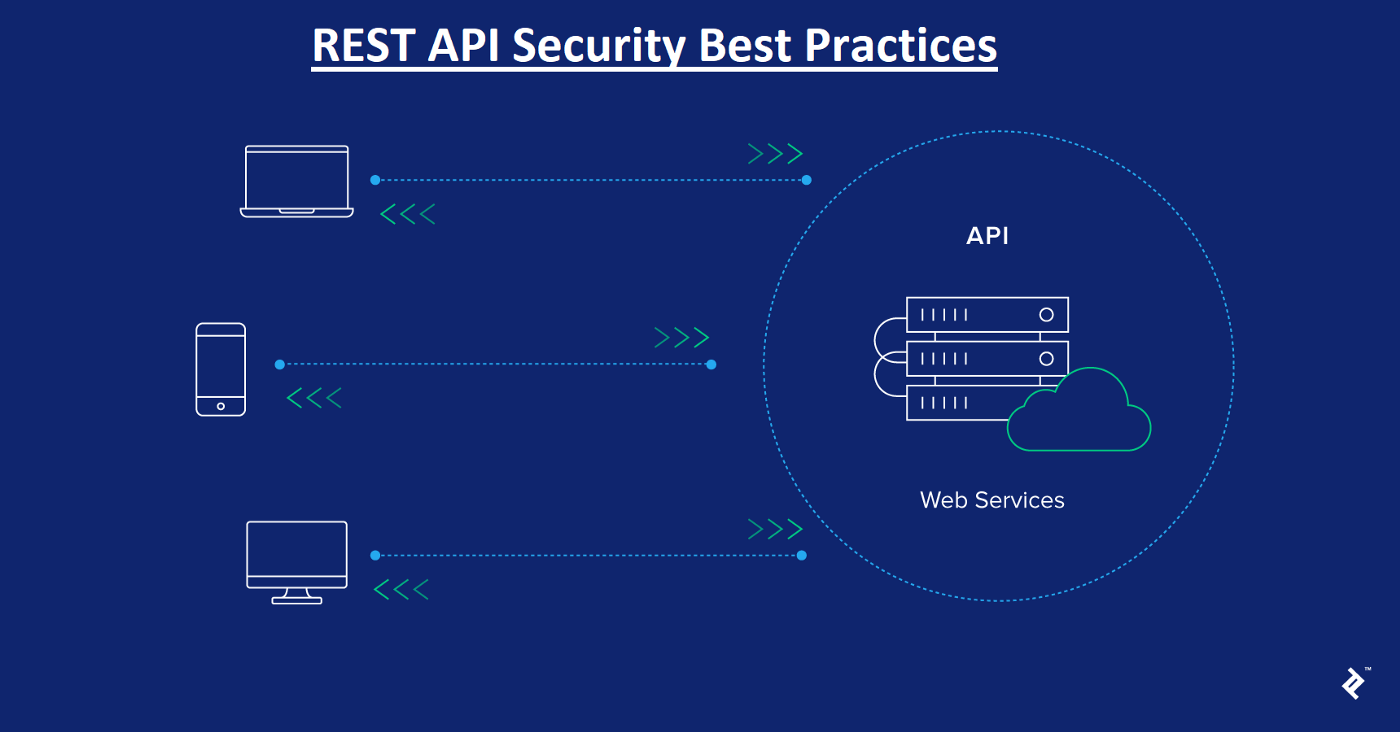

Identify and evaluate all potential cyber risks, including external threats, internal vulnerabilities, and regulatory compliance requirements. This assessment should encompass all areas of the organization, from technology infrastructure to employee awareness and training.

2. Customized Coverage

Work closely with insurance providers to customize the coverage to match the organization's specific needs. This may include coverage for business interruption, data restoration, legal expenses, regulatory fines, and public relations services.

3. Understand Policy Exclusions and Limitations

Carefully review the policy exclusions and limitations to fully understand what is covered and what is not. Ensure that the policy aligns with the organization's risk profile and requirements.

4. Cyber Risk Mitigation

Insurance providers may offer lower premiums or enhanced coverage options to organizations that have implemented robust cybersecurity measures. Implementing industry best practices such as strong access controls, regular security updates, employee training programs, and incident response plans can demonstrate a proactive approach to risk mitigation and potentially lead to more favorable insurance terms.

5. Incident Response Preparedness

Insurance companies often assess an organization's incident response capabilities before providing coverage. Develop and regularly test an incident response plan to demonstrate preparedness and ensure a swift and effective response in the event of a cyber incident. This can help organizations secure comprehensive coverage and potentially reduce premiums.

6. Coverage for First-Party and Third-Party Losses

Evaluate whether the cyber insurance policy covers both first-party losses (direct costs incurred by the insured organization) and third-party losses (liability arising from breaches that impact external parties). Comprehensive coverage should encompass both aspects to provide adequate protection.

7. Review Sublimits and Deductibles

Carefully review the sublimits and deductibles specified in the policy. Sublimits refer to the maximum amount payable for specific types of losses, while deductibles are the amount the insured organization must pay before the insurance coverage applies. Ensure that these limits align with the organization's risk tolerance and potential financial exposure.

8. Regular Policy Reviews and Updates

Cyber risks are constantly evolving, and the insurance landscape is continuously changing. Regularly review and update the cyber insurance policy to ensure it remains aligned with the organization's evolving risk profile and coverage needs.

Conclusion

In an increasingly digital and interconnected world, cyber insurance is a critical component of an organization's risk management strategy. By learning from past experiences and implementing best practices, organizations can obtain comprehensive coverage that mitigates financial losses and protects against the reputational damage caused by cyber incidents.

Lessons learned include conducting risk assessments, developing robust incident response plans, and vetting third-party vendors. Best practices for obtaining comprehensive cyber insurance coverage involve customization, understanding policy exclusions, risk mitigation, incident response preparedness, coverage for first-party and third-party losses, reviewing sublimits and deductibles, and regular policy reviews.

By following these practices, organizations can navigate the complex landscape of cyber insurance and enhance their resilience against evolving cyber threats.