The internet, a vast digital landscape that connects people worldwide, harbors a hidden side known as the dark web. This hidden realm is shrouded in anonymity and secrecy, facilitating illicit activities, including the sale of illegal goods and services.

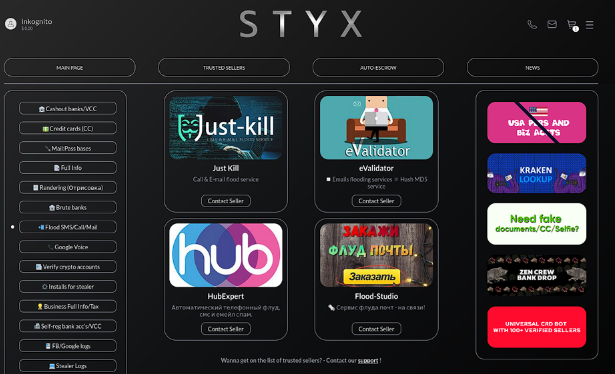

One such recent addition to the dark web marketplaces is STYX, a platform that has gained notoriety for specializing in financial fraud services. In this article, we will explore STYX, shedding light on its operations, the services it offers, and the implications for cybersecurity and financial institutions.

Unveiling STYX:

STYX, named after the mythological river separating the living world from the realm of the dead, is a dark web marketplace that operates on the Tor network. It has gained attention due to its focus on offering various financial fraud services to its clientele. The platform boasts an extensive array of services, including stolen credit card information, forged documents, hacking tools, and money laundering expertise. Its user-friendly interface and efficient escrow system make it appealing to cybercriminals seeking to exploit financial vulnerabilities.

Services Offered:

STYX's service catalog covers a wide range of financial fraud activities. One of its primary offerings is the sale of stolen credit card information. These stolen card details allow fraudsters to make unauthorized purchases, conduct identity theft, or even create cloned credit cards. Additionally, STYX provides access to forged documents, such as passports, driver's licenses, and social security cards. These documents enable criminals to assume false identities and carry out various illegal activities while evading law enforcement.

Moreover, STYX facilitates money laundering, offering assistance in converting illicitly obtained funds into legitimate-looking transactions. It provides guidance on using cryptocurrencies, mixing services, and even setting up shell companies to obfuscate the origins of illegal money.

Risks and Implications:

The emergence of STYX and other similar dark web markets specializing in financial fraud services poses significant risks to individuals, businesses, and financial institutions. Firstly, consumers are at risk of falling victim to identity theft, unauthorized transactions, and credit card fraud when their personal information is bought and sold on platforms like STYX. This can lead to severe financial losses and the painstaking process of reclaiming one's identity.

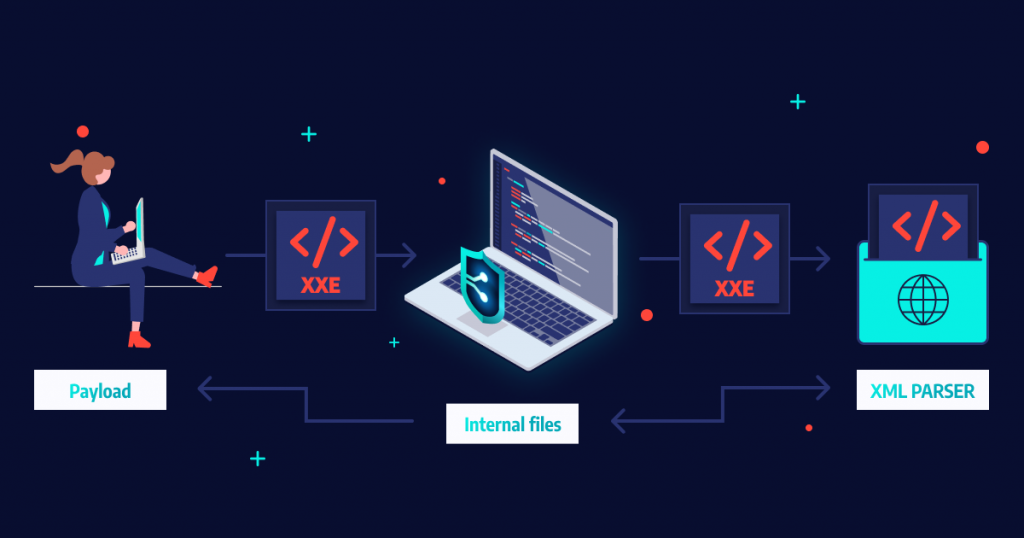

Financial institutions also face a mounting challenge in detecting and preventing fraudulent transactions facilitated by dark web marketplaces like STYX. Cybercriminals utilize advanced techniques and tools acquired through these platforms, making it increasingly difficult for banks and payment processors to differentiate between legitimate and fraudulent activities.

Furthermore, STYX's ability to offer forged documents exacerbates the problem by enabling criminals to bypass traditional identity verification measures, potentially leading to a surge in sophisticated scams and illegal operations.

Combating the Threat:

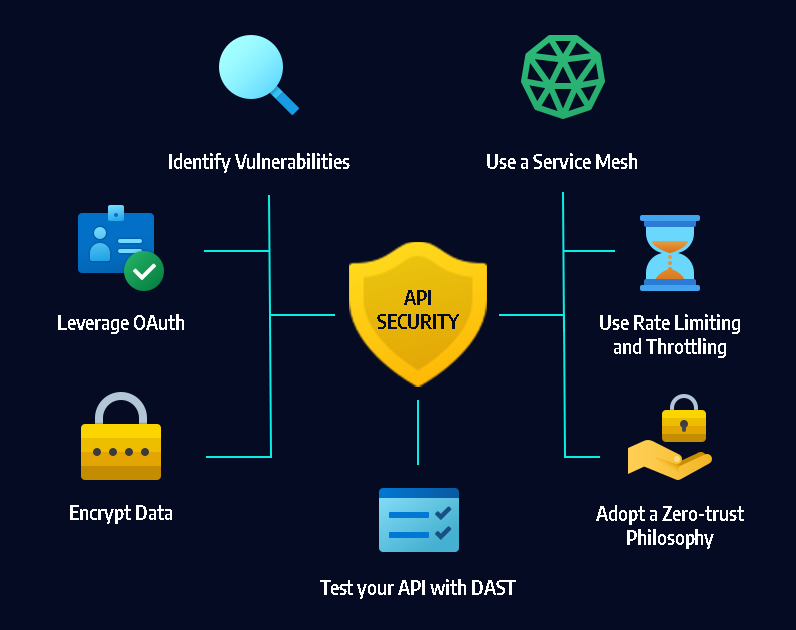

Authorities and cybersecurity professionals recognize the pressing need to combat the growing threat of dark web marketplaces like STYX. Law enforcement agencies actively collaborate with international partners to identify and shut down these illicit platforms. Additionally, organizations employ advanced technologies, machine learning algorithms, and artificial intelligence to detect patterns and anomalies indicative of financial fraud.

Education and awareness play a crucial role in mitigating the risks associated with dark web marketplaces. Individuals must remain vigilant, adopting secure online practices, such as using strong and unique passwords, regularly monitoring their financial accounts, and refraining from sharing sensitive information with untrusted sources.

Conclusion:

The rise of STYX and its specialization in financial fraud services highlights the ever-evolving landscape of cybercrime on the dark web. As consumers and businesses embrace digital transactions, the need for robust cybersecurity measures becomes paramount. Efforts to combat the threat posed by dark web marketplaces like STYX must continue to evolve, utilizing technological advancements and fostering public awareness to safeguard against financial fraud in the digital age.