With the increasing reliance on technology in today's business landscape, cyber attacks have become a significant threat. These attacks not only put sensitive data at risk but can also cause significant financial losses.

According to a report by Cybersecurity Ventures, cybercrime will cost businesses around the world over $6 trillion annually by 2021. In such a scenario, businesses need to prepare themselves to mitigate the financial implications of cyber attacks.

In this blog, we will discuss the importance of cyber insurance, its benefits, and how it can help businesses mitigate the financial impact of cyber attacks.

What is Cyber Insurance?

Cyber insurance is a type of insurance that covers businesses against losses incurred due to cyber attacks. This insurance policy covers the costs of recovery and restoration, including legal fees, fines, and penalties. Cyber insurance can also cover losses due to data breaches, cyber extortion, and other cyber-related incidents.

Benefits of Cyber Insurance

Financial Protection:

Cyber insurance provides financial protection against cyber attacks. The policy covers the costs of recovery and restoration, including legal fees, fines, and penalties. This can help businesses save a significant amount of money in the event of a cyber attack.

Reputation Protection:

Cyber attacks can damage a business's reputation, which can lead to a loss of customers and revenue. Cyber insurance can cover the costs of public relations and crisis management, which can help businesses protect their reputation.

Compliance:

Many businesses are required to comply with data protection regulations. Cyber insurance policies can cover the costs of compliance with these regulations.

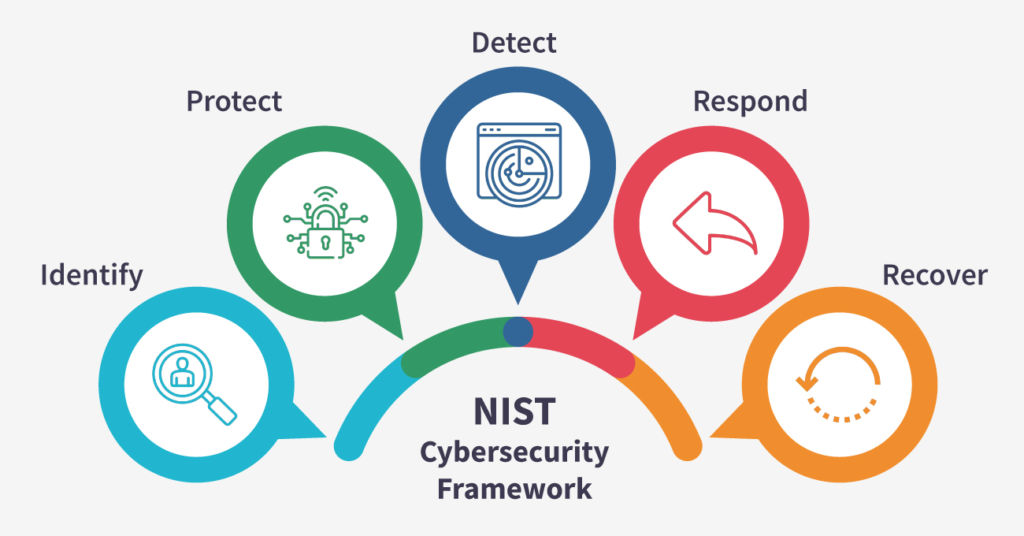

Risk Management:

Cyber insurance can also help businesses manage their cyber risk. Insurers can provide businesses with tools and resources to help them identify and mitigate their cyber risks.

Business Continuity:

In the event of a cyber attack, businesses may have to shut down their operations temporarily. Cyber insurance can cover the costs of business interruption, allowing businesses to continue operating while they recover from the attack.

How Cyber Insurance Can Help Mitigate the Financial Impact of Cyber Attacks

Recovering Lost Data:

Cyber insurance can cover the costs of data recovery in the event of a cyber attack. This can help businesses recover lost data and minimize the financial impact of the attack.

Restoring Systems and Networks:

Cyber attacks can cause significant damage to a business's systems and networks. Cyber insurance can cover the costs of restoring these systems and networks, allowing businesses to resume their operations quickly.

Legal Fees and Fines:

Cyber attacks can result in legal action against businesses. Cyber insurance can cover the costs of legal fees and fines, helping businesses avoid significant financial losses.

Crisis Management and Public Relations:

Cyber attacks can damage a business's reputation. Cyber insurance can cover the costs of crisis management and public relations, which can help businesses protect their reputation.

Business Interruption:

Cyber attacks can disrupt a business's operations, leading to a loss of revenue. Cyber insurance can cover the costs of business interruption, allowing businesses to continue operating while they recover from the attack.

Conclusion

In today's digital age, businesses face the risk of cyber attacks, which can cause significant financial losses. Cyber insurance plays a vital role in mitigating these losses by covering the costs of recovery and restoration. Cyber insurance can also help businesses manage their cyber risks, comply with data protection regulations, and protect their reputation. By investing in cyber insurance, businesses can prepare themselves for the potential financial impact of a cyber attack and minimize their losses.